inheritance tax rate kansas

The size of the inheritance. The state income tax rates range from 0 to 57 and the sales tax rate is 65.

Estate Tax Rates Forms For 2022 State By State Table

Connecticuts estate tax will have a flat rate of 12 percent by 2023.

. The sales tax rate in Kansas for tax year 2015 was 615 percent. The state income tax rates range from 0 to 57 and the sales tax rate is 65. Kansas does not have an estate tax or.

There is no federal inheritance tax but. Kansas taxes Social Security income only for those with an Adjusted Gross Income over 75000. Another states inheritance laws may.

If you make 70000 a year living in the region of Kansas USA you will be taxed 12078. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. Kansas Income Tax Calculator 2021.

The state sales tax rate is 65. The state has a progressive income tax with rates ranging from 310. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9.

In Nebraska immediate relatives must pay a 1 percent tax on the amount exceeding 40000. If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance. As of 2012 only those estate assets in excess of 5120000 are subject to the federal estate tax which has a.

Your average tax rate is 1198 and your marginal tax rate is. The kansas inheritance tax is based on the value of the assets received by the heir and the. Pennsylvania levies a 45 percent tax for children or lineal heirs.

Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570. The kansas inheritance tax is based on the value of the. If you are not an immediate.

However the states top inheritance tax rate 10 percent is the lowest of any of the six states and children spouses parents grandparents stepchildren stepparents. Like most states Kansas has a. Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570.

Also Kansas residents who inherit from Kansas estates or estates in other states need to understand inheritance tax because they may be responsible for paying an.

Individual Income Taxes Urban Institute

How Do State Estate And Inheritance Taxes Work Tax Policy Center

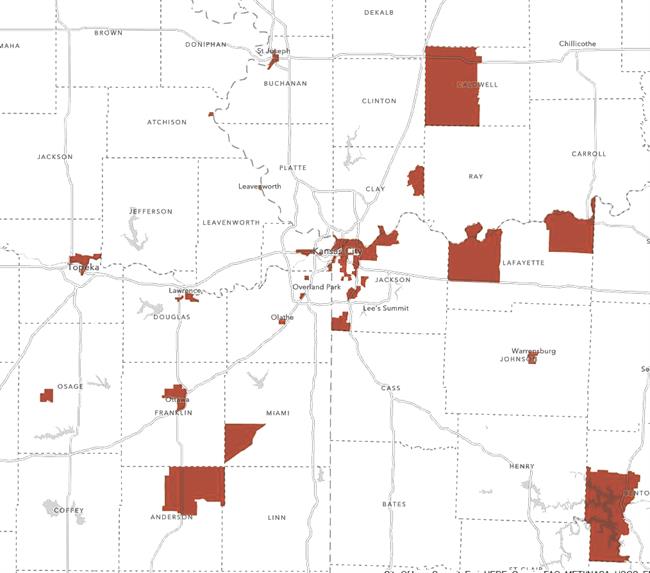

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

How Do State And Local Property Taxes Work Tax Policy Center

How To Create A Living Trust In Kansas Smartasset

Kansas Health Legal And End Of Life Resources Everplans

The Estate Tax And Real Estate Eye On Housing

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

Irs Announces 11 7 Million Exclusion For 2021 Estate Planning Attorneys In Missouri And Kansas

State By State Estate And Inheritance Tax Rates Everplans

Kc Region Taxes Financial Incentives Profile Kcadc

Death And Taxes Nebraska S Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Individual Income Taxes Urban Institute

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Death And Taxes Nebraska S Inheritance Tax

Is There An Inheritance Tax In Kansas Estate Planning Attorneys In Missouri And Kansas